COVID-19 continues to be the major headwind affecting all markets. Volatility remains extreme as news headlines regarding “flattening the curve” and potential treatments in the works for mitigating the effects of the virus shift markets up, only to be sent lower again when officials and medical professionals take to the airwaves and walk back previous comments.

The Black Swan Strikes! Gold Demand Ignites and Tests the Industry.

It came almost out of nowhere, a black swan event that engulfed the world. As everyone from citizens to governments scrambled to deal with COVID-19, the gold industry was impacted in unprecedented ways as well.

The Precious Metals Week in Review – April 10th, 2020

It was a shortened trading week due to markets being closed on Friday in observance of Easter and Passover.

Market volatility remains at extreme levels, with markets shifting and swinging on every headline that relates to the ongoing pandemic.

The Precious Metals Week in Review – April 3rd, 2020

The continued spread of COVID-19 remains the predominant factor affecting volatility in all markets. The emergency containment measures enacted worldwide to attempt to halt the outbreak have now been expanded in most countries, deepening the economic decline that began weeks ago.

Nine Meals from Anarchy

In 1906, Alfred Henry Lewis stated, “There are only nine meals between mankind and anarchy.”

Since then, his observation has been echoed by people as disparate as Robert Heinlein and Leon Trotsky.

Ask The Expert – “What is the ideal ratio of metals to hold to weather the economic storms on the horizon?”

One of our long-time clients recently submitted a question to our experts: What is the ideal ratio of metals to hold to weather the economic storms on the horizon?

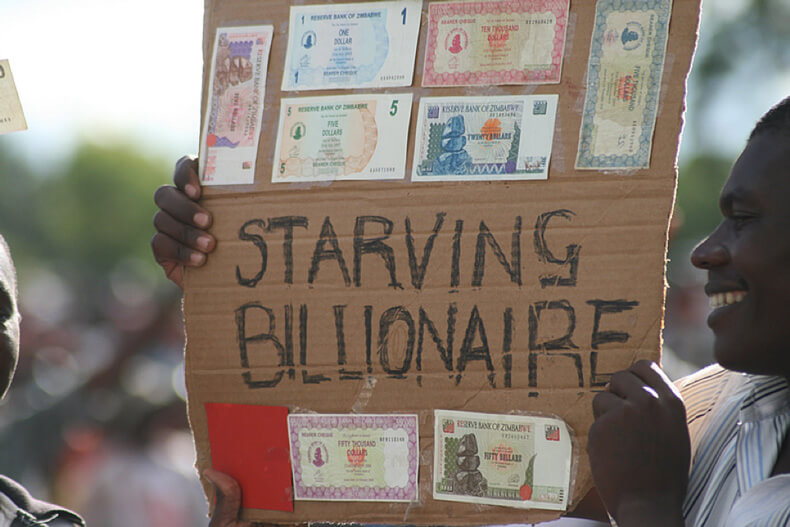

Starving Billionaire

Here we have an image from 2008. It records a Zimbabwean, making a visual comment on the fact that, in a matter of months, his country experienced government–driven hyperinflation that left him broke.

How to Stop Falling Dominos

I loved watching dominos fall as a kid. Setting up different arrangements was fun, but watching them fall was, of course, the most entertaining part.

The Economic Bubble Bath

At the end of a long, tiring day, we may choose to treat ourselves to a soothing bubble bath. Surrounded by steaming water and a froth of sweet-smelling bubbles, it’s easy to forget the cares of everyday life. This fact is equally true of economic bubbles.

Complain But Remain

All countries have a “shelf-life” of sorts. Generally, they begin when an old, top-heavy government collapses from its own weight. The end of the old regime is characterized by civil unrest, revolution, secession, economic collapse or some combination of these conditions.