U.S. stock indices fluctuated with FedEx earnings acting as a reality check after recent highs. Gold futures hit record prices over $2600 amidst economic uncertainty and anticipation of Fed rate cuts. Silver showed significant gains with a 10% rise, benefiting from positive investor expectations. The labor market showed improvement with a reduction in unemployment claims. Oil prices dipped despite a notable Fed rate cut, and currency trading saw significant movements with the USD/JPY rallying and EUR/USD facing pressure. Investors continued diversifying into precious metals as a hedging strategy.

The Precious Metals Week in Review – December 8th, 2023

Gold went on a run late last week, setting an all-time record high last Friday and breaking the $2,100 level for a brief time in overseas trading Sunday night.

Gold in Q1: Hello, Banking Crisis

The shocking closure of two US banks, the Fed slowing interest rate hikes, and a weakening US dollar all roiled markets and led to a spike in gold demand.

Gold in Q1: Price Softens, But New Catalysts Emerge

The most likely scenario for the remainder of 2021 is one where gold and silver continue to offer meaningful and necessary hedges, along with the distinct possibility of record-high prices.

The Secret to Understanding Gold’s True Value

Since gold and silver are money, it’s important to view them as such, and not as “investments”. Yes, we’re convinced we’ll make a profit on them, but the deeper purpose lies in their monetary value.

Gold’s Highest Quarterly Close in History

As we move into the second half of 2020, gold is increasingly likely to serve as an effective and necessary hedge, particularly in light of the Fed’s dovish stance, ongoing geopolitical conflicts, and the risks associated with the recession, stock market volatility, and US election.

Is the Extreme High in the Gold/Silver Ratio Setting Up For an Extreme Reversal?

There are a few times in an investor’s life where, as Jim Rogers once put it, you see a pile of money sitting in a corner and you can go pick it up.

The Black Swan Strikes! Gold Demand Ignites and Tests the Industry.

It came almost out of nowhere, a black swan event that engulfed the world. As everyone from citizens to governments scrambled to deal with COVID-19, the gold industry was impacted in unprecedented ways as well.

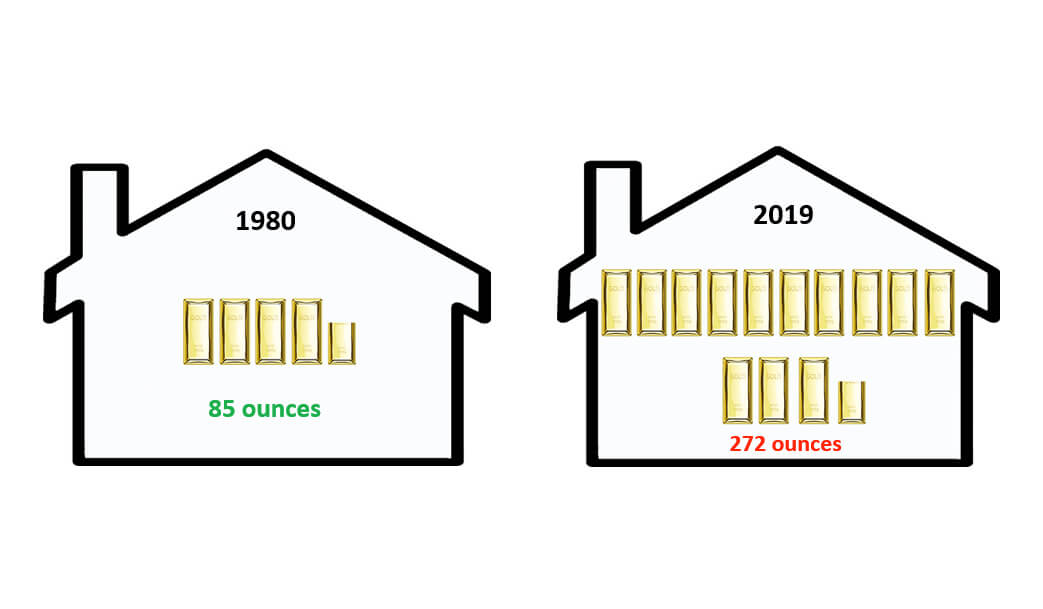

Gold and Silver Could Someday Make a Vacation Home Very Affordable

One of the articles that elicited a lot of reader feedback was our report on the ratios for gold and silver to real estate. That was over a year ago, and with gold and silver prices rising, it’s time for an update.

Getting Nervous About the Stock Market? Here’s Your Antidote.

By Jeff Clark, Senior Analyst, GoldSilver and Adviser for Strategic Wealth Preservation. If you didn’t catch it, gold has passed the S&P 500 in year-to-date performance. Through August 12, gold is up 18.1%, while the S&P has risen 13.8%. Silver is nipping its heels, now up 10.2% YTD. But what is perhaps more significant is…