As politics around the world and ongoing worldwide health concerns continue to feed uncertainty, investors continue to regard precious metals, particularly gold and silver.

Currency Creation vs. Bullion Production: The Overwhelming Reason to Buy Gold & Silver Today

How does the Fed’s monthly currency creation of $120 billion compare to the value of monthly gold and silver production?

Coke & Pepsi

In the world of Precious Metals investment, the Coke and Pepsi are American Eagles and Canadian Maple Leafs.

The Precious Metals Week in Review – September 18th, 2020

As market volatility continues to swing, many continue purchasing physical precious metals, given the promising opportunities of the present moment.

Is Silver the Next Tesla?

Given silver’s historical volatility, a question dawned on me: could silver log a similar runaway price advance in the not-too-distant future?

Resumen de la Semana en Metales Preciosos – Septiembre 12 de 2020.

Los metales preciosos siempre deben ser vistos como una inversión a largo plazo y que la clave para la rentabilidad es adquirir, poseer los productos físicos y mantenerlos a largo plazo.

The Precious Metals Week in Review – September 11th, 2020

In the face of the ongoing crises around the world, wise investors have continued to attempt to ensure that their portfolios remain well-diversified against overexposure to any single asset class.

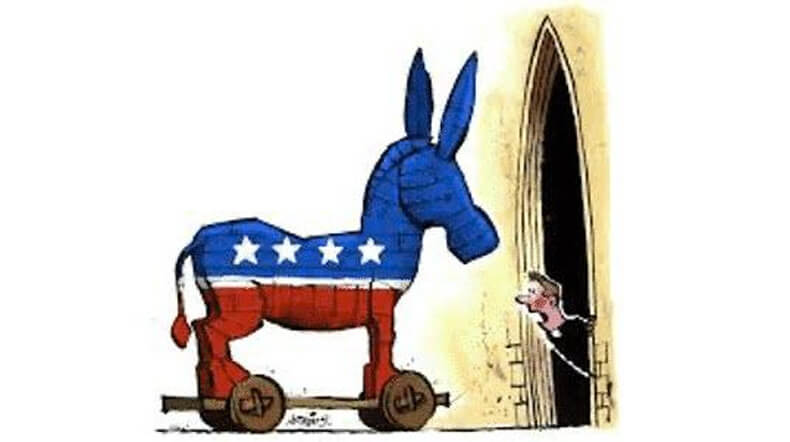

The Trojan Donkey

The American public are therefore left to ponder whether it may be that a vastly unpopular Trojan Donkey may be closer to the presidency than she presently appears.

Weekly Precious Metals Update – September 7th, 2020

How high can the gold price go? … with the demand from institutional and pension funds, there is no reason to believe that we won’t be seeing $3000 gold in the next 12 months.

Resumen de la Semana en Metales Preciosos – Septiembre 5 de 2020.

Muchos inversores han tenido en cuenta el rol histórico de los metales preciosos en físico como refugio seguro en tiempos de crisis económica y geopolítica y los han utilizado acordemente para diversificar sus carteras.