A lot of readers liked our article on how much cash could flood the gold market once institutional investors start buying. Now it’s time to look at silver.

What a Gold Shock Could Look Like: Institutional Investors Start Buying

By Jeff Clark, Senior Analyst, GoldSilver and Adviser for Strategic Wealth Preservation. I once asked my institutional investor friend, who used to work at Goldman Sachs and has been a gold owner for many years, what would make him buy more bullion. Without hesitation he said, “When the price breaks out.” Well, as is clear…

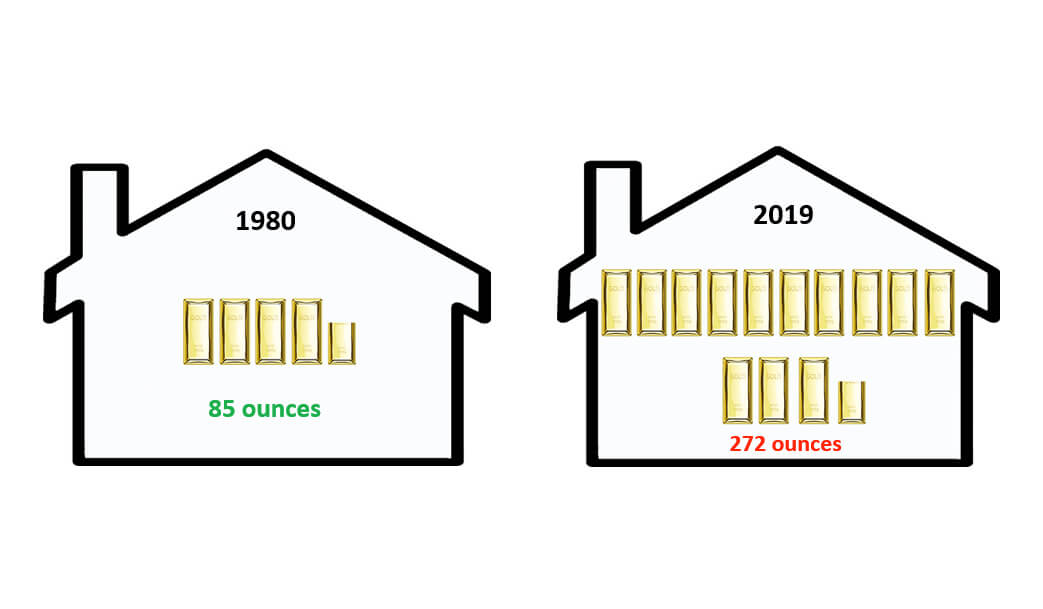

Gold and Silver Could Someday Make a Vacation Home Very Affordable

One of the articles that elicited a lot of reader feedback was our report on the ratios for gold and silver to real estate. That was over a year ago, and with gold and silver prices rising, it’s time for an update.

Getting Nervous About the Stock Market? Here’s Your Antidote.

By Jeff Clark, Senior Analyst, GoldSilver and Adviser for Strategic Wealth Preservation. If you didn’t catch it, gold has passed the S&P 500 in year-to-date performance. Through August 12, gold is up 18.1%, while the S&P has risen 13.8%. Silver is nipping its heels, now up 10.2% YTD. But what is perhaps more significant is…

Does Gold’s Breakout Mean Silver is on the Launchpad? Three… Two… One…

Gold and silver prices continue to push higher. They’re starting to get some attention from the mainstream, too.

Silver vs. the S&P 500: History Says One Could Be Crushed, the Other a Super-Charged Bubble

Many readers liked the tables we presented of possible gold/S&P 500 ratios and what that would mean to prices of each asset. If you didn’t catch it, check out what the future could look like for gold vs. the stock market.

Dear Stock Investor, I’m About to Steal Profits Right out of Your Brokerage Account

Dear Main Street and Wall Street Investor, I’m a pretty nice guy. But you may not think so if what I outline below comes to pass.

Has the Gold/Silver Ratio Started a Reversal?

If you haven’t noticed, silver’s on the move. The price reached a new 52-week high yesterday. And the gold/silver ratio—an indicator many analysts, including me, track to determine if one or the other metal is lagging its historical performance—has fallen 8% over the past eight trading days.

How to Stop Falling Dominos

I loved watching dominos fall as a kid. Setting up different arrangements was fun, but watching them fall was, of course, the most entertaining part.

Gold Q2 Highlights: Breakout!

This brief report will highlight what’s taken place with precious metals this past quarter and year-to-date, along with how they compared to other assets. We’ll also briefly look at what potential catalysts lie ahead.