As the coronavirus continues to mutate and spread, savvy investors know well the role that safe-haven investments play in protecting portfolios.

Inauguration Day Isn’t For Biden – It’s For Silver!

Are you ready for silver’s inauguration day? With all that is expected over the next four years, it is not a stretch to say that silver could be the best performing asset.

Exclusive Interview with Jeff Thomas

After an unsettling 2020, we interviewed Jeff to get his take on where we’ve been and what the future might hold.

Gold in 2020: Record Highs, With Catalysts Pointing to More

The most likely scenario for 2021 is one where gold continues to offer a meaningful and necessary hedge, along with the high probability of yet another set of record-high prices.

The Precious Metals Week in Review – January 15th, 2021

This week, investors seemed to wonder for the first time if the stock market euphoria had not gone too far. The Precios Metals Week In Review.

The Precious Metals Week in Review – January 8th, 2021

Market euphoria reached unprecedented levels this week as markets and stocks reached new highs while political unrest shook this country’s core.

Watch Out for the Shoeshine Boys

Joseph Kennedy decided that, when even shoeshine boys are offering stock tips, it’s time to get out of the market.

The Precious Metals Week in Review – December 31st, 2020

The key to profitability through the ownership of physical precious metals is to acquire the physical product and hold on to it for the long term.

The Precious Metals Week in Review – December 24th, 2020

As market volatility continues to swing, many continue purchasing physical precious metals.

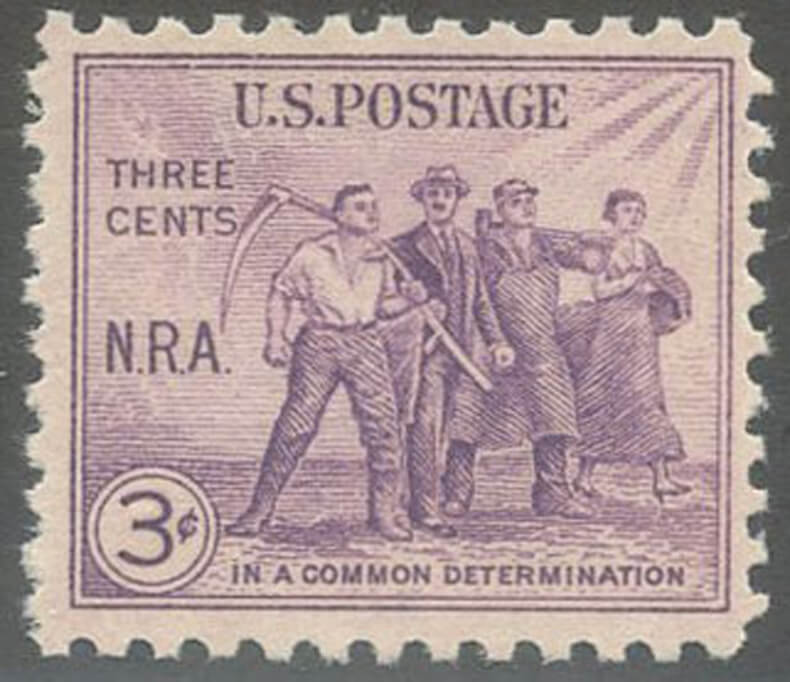

Is Collectivism Inevitable?

Although collectivism in all its guises socialism, communism, fascism, etc. has proven to be an utter failure wherever it has been implemented.