Volatility should be expected to remain high as investors will be closely watching for hints on upcoming monetary policy direction.

The Precious Metals Week in Review – January 20th, 2023

Many investors have included physical precious metals as part of their diversification plans, given their long history as a hedge against both inflation and during times of economic turmoil.

The Precious Metals Week in Review – January 13th, 2023

The key to profitability through the ownership of physical precious metals is to own the physical product and hold it for the long term.

Should You Be Worried?

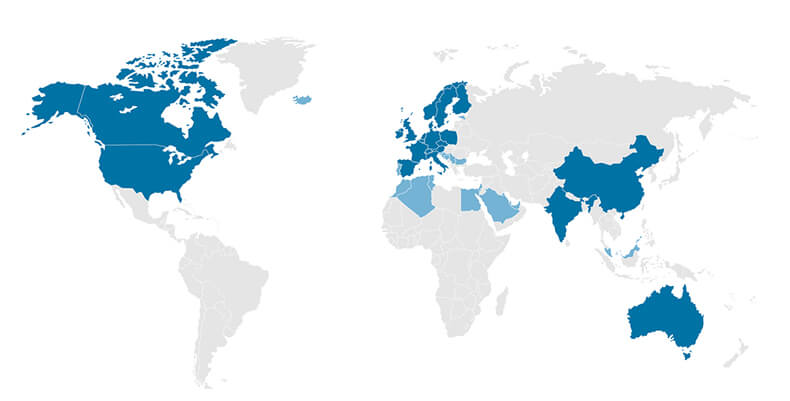

Governments, particularly in the First World countries, are headed in a decidedly totalitarian direction and the frequency and magnitude of the changes being implemented are on the increase.

Sanctimania

Sanctimania can be defined as the point at which personal opinion encroaches upon the personal liberty of others.

The Precious Metals Week in Review – January 6th, 2023

1. Happy New Year! And to start off this New Year we have the International Monetary Fund Managing Director Kristalina Georgieva warning that the global economy faces “a tough year, tougher than the year we leave behind. We expect one-third of the world economy to be in recession,” Georgieva said in an interview aired on…

The Precious Metals Week in Review – December 30th, 2022

Astute investors take added steps to help ensure that their portfolios are well-diversified in the event of a drastic downturn in the global economy.

The Precious Metals Week in Review – December 23rd, 2022

Investors continue to stick to their plans to add physical precious metals to their portfolios whenever temporary price dips present themselves at a discount.

The Precious Metals Week in Review – December 16th, 2022

Investors continue to stick to their plans to add physical precious metals to their portfolios whenever temporary price dips present themselves at a discount.

The Precious Metals Week in Review – December 9th, 2022

investors have continued to add physical precious metals as part of a well-diversified portfolio as the entire precious metals sector has outperformed the Dow over the past year.