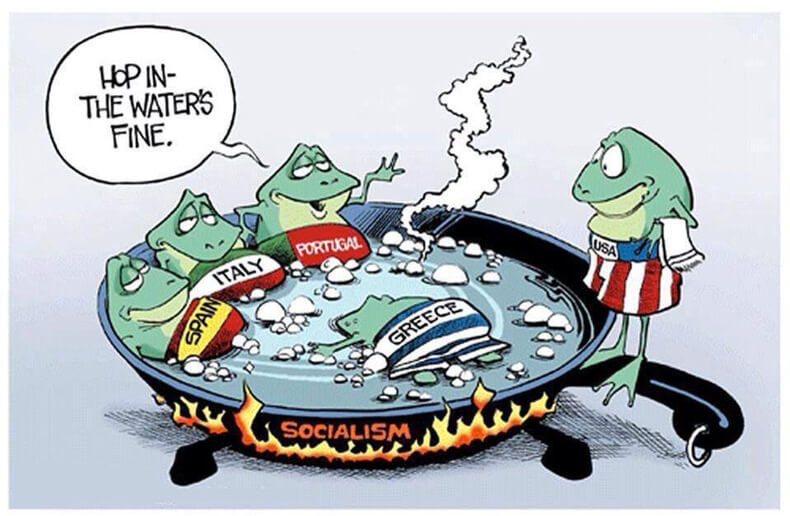

Recently, many political hopefuls on the Left in the US have “come out” as socialists. Some may have been socialists all along, whilst others may merely be hoping to cash in on the popularity of avowed socialist Bernie Sanders in 2016.

The Precious Metals Week in Review – September 20th, 2019

The ongoing trade dispute between the U.S. and China, uncertainty over the direction of U.S. monetary policy and continued uncertainty over the United Kingdom’s exit from the European Union all remain the primary drivers for market moves in the near term. A clearly sophisticated strike on Saudi Arabian oil facilities over the weekend also acted to send uncertainty and fear into markets.

The Big Silver Shock: Institutions Decide to Invest

A lot of readers liked our article on how much cash could flood the gold market once institutional investors start buying. Now it’s time to look at silver.

World Gold Council releases its Responsible Gold Mining Principles

The World Gold Council has released its Responsible Gold Mining Principles (RGMP), a framework for market stakeholders as to what constitutes responsible mining.

Brother In Arms

Mayer Amschel Rothschild died in 1812, so he could hardly be referred to as a pal of Xi Jinping, but the two have a great deal in common.

What a Gold Shock Could Look Like: Institutional Investors Start Buying

By Jeff Clark, Senior Analyst, GoldSilver and Adviser for Strategic Wealth Preservation. I once asked my institutional investor friend, who used to work at Goldman Sachs and has been a gold owner for many years, what would make him buy more bullion. Without hesitation he said, “When the price breaks out.” Well, as is clear…

The Precious Metals Week in Review – September 13th, 2019

1. Primary market drivers remain the ongoing trade war between China and the United States and the continued chaos surrounding the United Kingdom’s alleged and upcoming exit from the European Union. All eyes will be on the Federal Reserve next week as they hold their Federal Open Market Committee (FOMC) meeting to determine the course…

Lessons Learned in Las Vegas

Admittedly, Las Vegas is not my favorite place in the world. There are many other cities where I’d rather spend my free time. But out of necessity, I do find myself there fairly regularly, and if nothing else, Sin City has provided me with two very valuable life lessons, which can be applied to either gambling or investing in precious metals.

The Precious Metals Week in Review – September 6th, 2019

1. It was a shortened week with the celebration of the Labor Day holiday in the U.S. The primary market drivers remained the U.S.-China trade war and the escalating political crisis in the United Kingdom as they continue to struggle with meeting the upcoming Brexit deadline in October. 2. Hurricane Dorian turned into a complete…

The Missing Piece to the Puzzle

Gold and silver are experiencing an impressive rally at the moment. This is all good news for precious metal investors, who have been waiting a long time for this rally.