Throughout the history of the world, whenever a country had entered its decline stage, others were in the process of rising up.

Gold Hits All-Time Highs, Then Consolidates

As we move into the final quarter of this tumultuous year, gold is increasingly likely to serve as a hedge of absolute necessity…

The Precious Metals Week in Review – October 16th, 2020

This week, the S&P 500 and Dow Jones Industrial Average fell for three consecutive days; this is the longest losing stretch since September.

Love It or Leave?

Those who may love their country, but do not love what it’s become, may choose to leave the herd whilst greener pastures remain an option.

When Will the Divisiveness End?

Anyone who finds that he has already been programmed to hate the opposing group or party is already an operative of the state. When Will the Divisiveness End?

The Precious Metals Week in Review – October 9th, 2020

Savvy investors continue to watch the precious metals markets for opportunities to buy at a discount.

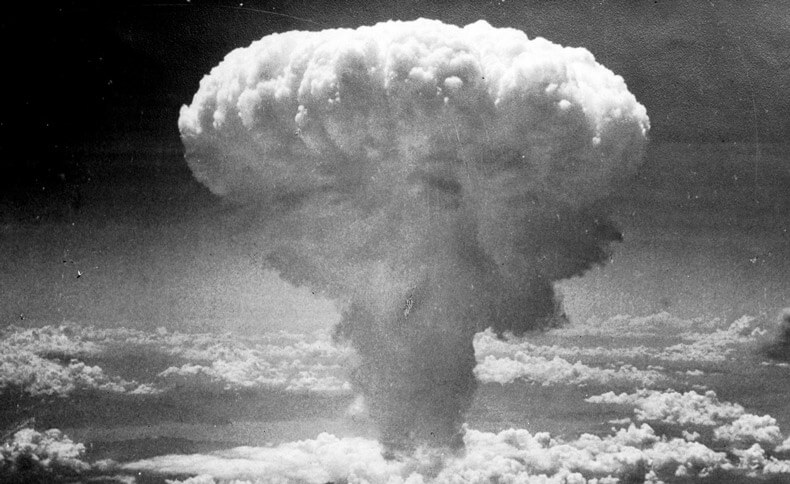

The Nuclear Election

The reader may wish to ponder whether the powers that be are pursuing a larger agenda – a change in US governance, ushered in by a divisive nuclear election.

The Precious Metals Week in Review – October 2nd, 2020

The key to profitability through the ownership of physical precious metals is to acquire the physical product and hold on to it for the long term.

The Precious Metals Week in Review – September 25th, 2020

As politics around the world and ongoing worldwide health concerns continue to feed uncertainty, investors continue to regard precious metals, particularly gold and silver.

Currency Creation vs. Bullion Production: The Overwhelming Reason to Buy Gold & Silver Today

How does the Fed’s monthly currency creation of $120 billion compare to the value of monthly gold and silver production?