The Sandcastle – An article by: Jeff Thomas.

Sex, Drugs & Rock ‘n’ Roll

The boomer generation reached their teens in the 1960s, and having grown accustomed to receiving whatever they wanted in life, they were young adults and wanted to party. The phrase, “sex, drugs and rock ‘n’ roll” was coined and it was an apt one.

Those Who Seek to Rule

We’d like to think that all people have a sense of compassion and fair play, but this isn’t so. Roughly ten percent of all people, in any population, are estimated to have traits associated with narcissism. Roughly four percent are estimated to be sociopathic and one percent are estimated to be psychopathic.

Will They Take All Your Money?

Why not? It’s not yours. Most people assume that, if they have money on deposit in a bank, they own that money. That’s not necessarily the case.

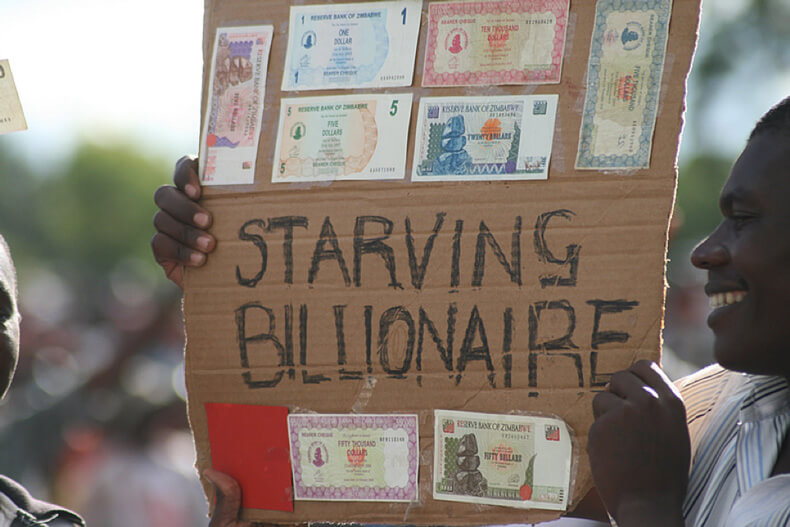

Starving Billionaire

Here we have an image from 2008. It records a Zimbabwean, making a visual comment on the fact that, in a matter of months, his country experienced government–driven hyperinflation that left him broke.

How to Stop Falling Dominos

I loved watching dominos fall as a kid. Setting up different arrangements was fun, but watching them fall was, of course, the most entertaining part.

The Economic Bubble Bath

At the end of a long, tiring day, we may choose to treat ourselves to a soothing bubble bath. Surrounded by steaming water and a froth of sweet-smelling bubbles, it’s easy to forget the cares of everyday life. This fact is equally true of economic bubbles.

Why an Epic Bull Market in Gold Is About to Begin

Last week, I laid out four reasons for why this gold rally will be bigger than anything we’ve ever seen. I explained how central banks are buying up piles of gold… how China is using the metal to remove its dependence on the U.S. dollar… and why the Fed’s shifting strategy is bullish for the sector.

Defining Liberty

Here we have a most interesting collection of signage. Some low-level civil servant who’s in charge of deciding what the motorist may do at this particular junction has become quite thorough in creating restrictions.

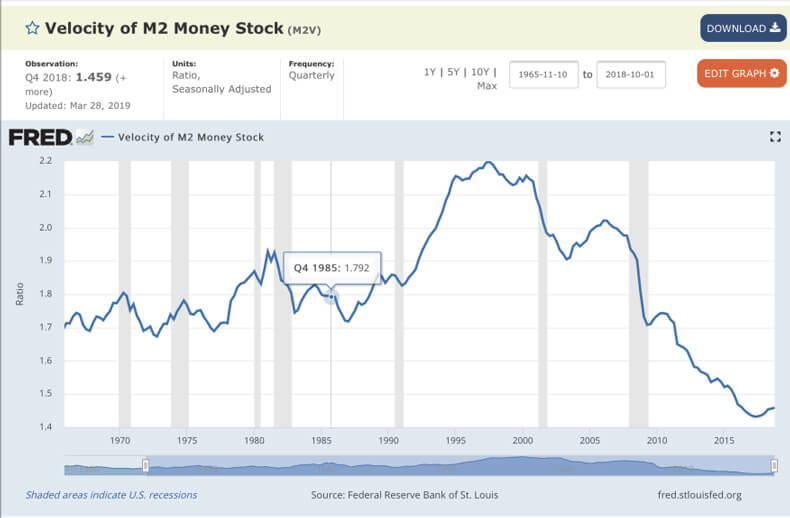

All That’s Missing Is a Black Swan

The Federal Reserve chart above only goes back to 1970, but its message is clear, nevertheless. The velocity of money has dropped below that which was necessary to maintain a productive economy in 2009 and has never recovered.