JPMorgan Chase sees an opportunity in gold ahead of a likely U.S. recession, predicting prices will push past $2,000 an ounce by year-end and hit fresh records in 2024 as interest rates start to fall.

The Precious Metals Week in Review – July 21st, 2023

Some of the forecasters who were first out of the box to predict a U.S. recession are starting to hedge their bets as inflation ebbs and the economy remains resilient.

Inflation: Your Role as a Milk Cow

An article by Jeff Thomas, feature writer for Strategic Wealth Preservation, Doug Casey’s International Man and 321gold.com Traditionally, inflation has been defined as “an increase in the amount of currency in circulation.” Such an increase almost always causes an increase in the cost of goods and services, since, more plentiful currency units lowers their rarity,…

The Precious Metals Week in Review – July 14th, 2023

Major banks are facing one of the biggest regulatory overhauls since the financial crisis, setting up a clash over the amount of capital that they must set aside to weather the tumult.

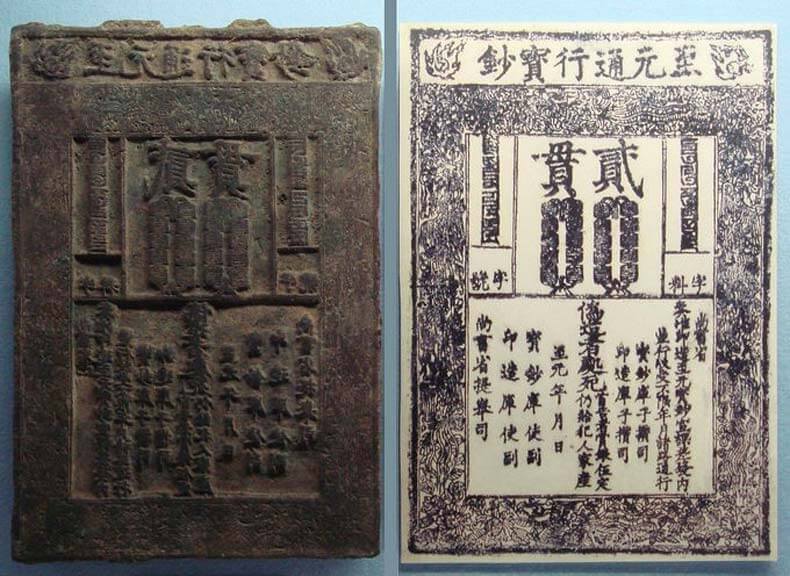

Like So Much Mulberry Bark

In 1260, Kublai Khan created the first unified fiat currency. The jiaochao was made from the inner layer of the bark of the mulberry tree. It’s of interest that the mulberry tree was quite common in Mongolia.

The Precious Metals Week in Review – July 7th, 2023

Geopolitical, economic, and environmental uncertainty can be expected to continue in the near term. Astute investors continue to seek out alternative investments for their portfolios to aid in diversifying them away from overexposure to any single asset class.

When in Rome

The Roman denarius pictured above features the profile of the emperor Diocletian, circa 301 AD, at the time when he issued the edict listed above.