Escalating trade disputes between the U.S. and other nations of the world remain the primary driver for market volatility.

The Precious Metals Week in Review – May 24th, 2019

The rapidly deteriorating trade relationship between the U.S. and China was of primary focus this week, followed by further deterioration in the Brexit negotiation process in Europe.

Silver Supply/Demand Crunch Part II: Primary Silver Producers Stuck in Quicksand and Still Sinking

As we outlined in our silver supply/demand crunch article, the silver market has entered a structural imbalance. It is not temporary. Global supply is locked into a decline, leaving the industry ill-equipped to respond meaningfully to any spike in demand of physical metal for the foreseeable future.

The Precious Metals Week in Review – May 17th, 2019

The collapse of the trade talks between the U.S. and China was the primary driver for stock market moves this week. Ongoing uncertainty over the Brexit negotiations was also a factor in market volatility as well as increased tensions in the Middle East.

Defining Liberty

Here we have a most interesting collection of signage. Some low-level civil servant who’s in charge of deciding what the motorist may do at this particular junction has become quite thorough in creating restrictions.

Silver in Charts: Supply/Demand Crunch After Years of the Opposite

The data is in: based on a review of reports from multiple consultancies, the silver market has officially entered a supply/demand imbalance. The structure now in place sets up a scenario where a genuine crunch could occur.

The Precious Metals Week in Review – May 10th, 2019

Escalating tensions in the trade talks between the U.S. and China sent markets lower as President Trump threatened to enact a tariff increase on Chinese goods beginning Friday. When the U.S. followed through on its threat at midnight on Friday morning, stocks plunged as equity markets apparently had not been pricing in the fact that the deal could collapse so quickly.

All That’s Missing Is a Black Swan

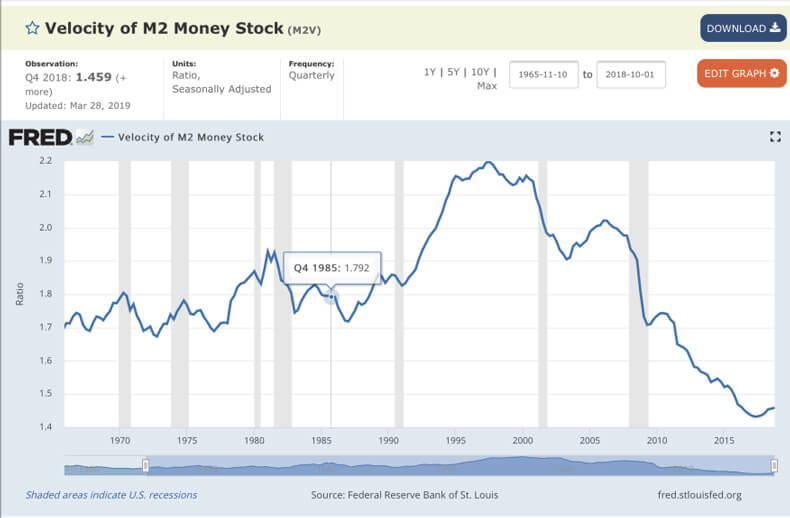

The Federal Reserve chart above only goes back to 1970, but its message is clear, nevertheless. The velocity of money has dropped below that which was necessary to maintain a productive economy in 2009 and has never recovered.

The Precious Metals Week in Review – May 3rd, 2019

The U.S. Federal Reserve was the primary driver for market movements this week as analysts awaited the release of the Non-Farm Payrolls report for April on Friday.