Gold has soared to record highs above $3,800 an ounce, while silver, platinum, and palladium also climb amid Fed rate cuts, a weaker dollar, and economic turmoil. Precious metals continue to prove their strength as a hedge against inflation and global uncertainty, securing their role in long-term wealth preservation.

The Precious Metals Week in Review – September 19th, 2025

Gold held close to record highs after the Federal Reserve’s first rate cut of 2025, underscoring precious metals’ enduring appeal as a hedge against inflation, market turbulence, and economic uncertainty. Diversifying with physical metals remains a proven strategy for preserving long-term wealth.

Food Crisis – The Greatest Threat to Social Stability

While the US and Europe have seen many riot situations and we can therefore study how they play out, a series of self-perpetuating riots has not taken place before.

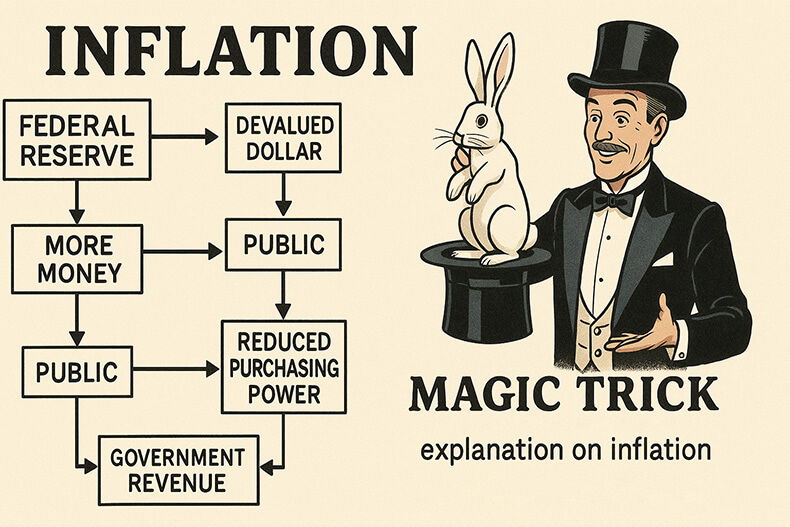

The Magic Trick

Explore how inflation, orchestrated by the Federal Reserve, acts as a hidden tax. This powerful illustration exposes the illusion behind the dollar’s decline.

The Precious Metals Week in Review – April 18th, 2025

In a week of economic chaos, gold proved its resilience—shattering records and reaffirming its status as the ultimate safe haven. With inflation risks, volatile tech stocks, and global uncertainty mounting, precious metals are once again in the spotlight. Is this the beginning of a new golden era?

The Precious Metals Week in Review – January 31st, 2025

Gold continues to outperform the weakening Canadian dollar, hovering near C$4,000 as the Bank of Canada lowers rates and ends quantitative tightening. Meanwhile, tech stocks struggle due to concerns over AI competition, and U.S. bonds rise as investors seek safety amid market volatility.

The Precious Metals Week in Review – January 24th, 2025

Gold prices have soared past $2,700 per ounce as inflation concerns and economic uncertainty push investors toward safe-haven assets. Analysts predict that gold could reach the significant resistance level of $3,000 an ounce later this year. Despite some consolidation, the precious metal is showing impressive strength against major global currencies. Investors are increasingly eyeing gold as a hedge against rising economic volatility and inflation, with gains expected to continue as the U.S. dollar remains strong.

The Precious Metals Week in Review – January 17th, 2025

As the U.S. dollar strengthens in 2025, investors face mixed consequences. With a 10% rally since September, inflation and interest rates remain crucial variables. Investors eye opportunities in gold and silver, while concerns about mounting debt and global capital flows continue to drive market volatility and uncertainty.

The Precious Metals Week in Review – January 10th, 2025

U.S. stocks plunged on Friday as investors digested a final 2024 jobs report that blew past expectations on hiring, raising more uncertainty about the path of interest rates this year.

The Precious Metals Week in Review – December 13th, 2024

U.S. consumers anticipate higher inflation despite optimism about personal finances. The New York Fed notes improved income expectations, but the job market outlook weakens. Meanwhile, inflation data shows moderate increases, and concerns remain over mortgage rates, which are predicted to stay above 6%. Precious metals, including gold and silver, exhibit notable price movements amid market volatility.