Astute investors continue to seek out alternative investments for their portfolios to aid in diversifying them away from overexposure to any single asset class.

The Precious Metals Week in Review – October 14th, 2022

As geopolitical, economic, and environmental uncertainties escalate, many investors watching these volatile moves continue to try to take steps to diversify their portfolios and seek out alternative investments.

What Would Be the Aftermath of a Globalist Failure?

Internal collapse may arguably be a good way to introduce a totalitarian rule to the US, but it’s not a viable means to remain a global leader afterward.

The Precious Metals Week in Review – August 19th, 2022

Investors continue to take advantage of temporary price dips to add additional physical precious metals into their investment portfolios in hopes that it will aid in their diversification efforts.

The Precious Metals Week in Review – August 5th, 2022

Physical precious metals have a long history of being viewed as a hedge against geopolitical uncertainty, economic turmoil, and inflation.

The Precious Metals Week in Review – July 15th, 2022

For those investors back in 1956, who bought one ounce of gold for 35 dollars, however, they could have sold that same ounce today for over $1700 – an increase of 4,757%.

Does China Have Enough Gold Reserves to Launch a Gold Standard?

We don’t know exactly what China’s plans may be, but it would not be surprising in the least if they’re preparing now to pounce at the next crisis, particularly a monetary one.

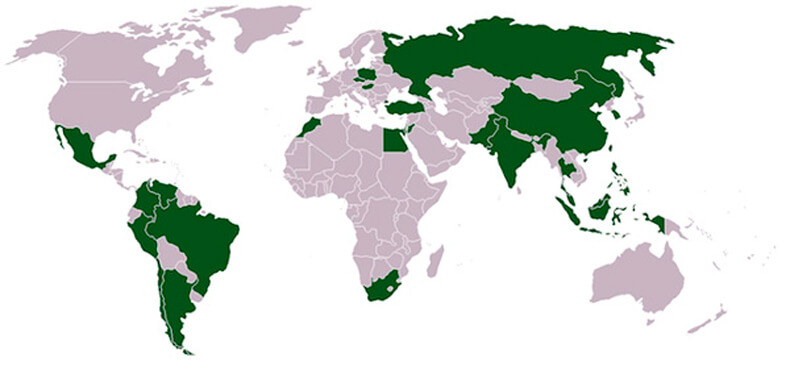

The Next Empire

China, Russia, and the rest of the world, when faced with American threats and bluster, will not simply fold their tents and accept that the US must be obeyed.

The Precious Metals Week in Review – November 26th, 2021

As inflation indicators have continued to climb, many investors have returned to acquiring physical precious metals whenever buying opportunities in the form of temporary price dips present themselves.

The Precious Metals Week in Review – October 22nd, 2021

Savvy investors have continued to seek out ways to ensure that their portfolios remain diversified against unforeseen plunges in other markets.