Gold prices spiked as market uncertainty deepened following the U.S. credit rating downgrade and renewed global trade tensions. With equities volatile and economic data mixed, investors are seeking refuge in precious metals. This surge highlights gold’s enduring role as a hedge against financial instability and inflation.

The Precious Metals Week in Review – May 16th, 2025

Amid easing U.S.-China trade tensions, investor confidence grows—but so does market uncertainty. Discover why physical precious metals remain a key asset for long-term portfolio resilience in volatile economic times.

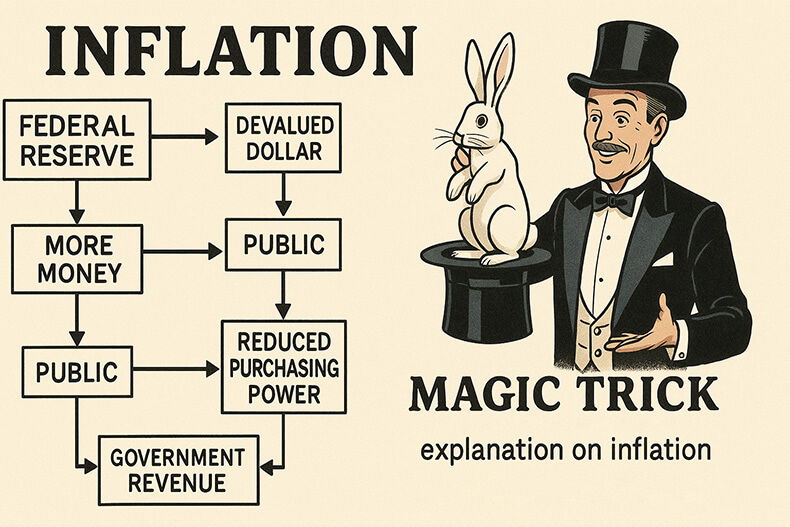

The Magic Trick

Explore how inflation, orchestrated by the Federal Reserve, acts as a hidden tax. This powerful illustration exposes the illusion behind the dollar’s decline.

The Precious Metals Week in Review – May 9th, 2025

With mortgage rates holding steady and the dollar declining, investors are increasingly turning to gold. Amid global volatility, central bank demand, and stagnant mining output, gold continues its 25-year outperformance streak—making it a compelling long-term hedge against economic uncertainty.

The Precious Metals Week in Review – May 2nd, 2025

With tech stocks sliding and inflation indicators in flux, gold surged as investors sought stability. Precious metals once again prove their power in uncertain markets. Amid shifting labor data, crypto losses, and volatile oil, gold shines as a cornerstone of smart diversification.

The Endlessness of a Temporary Tax

Politicians love tax reform—until it’s time to actually lower taxes. This deep dive into the “temporary” telephone tax reveals how reforms are often just reshuffles. Learn how a war from 1898 still affects your phone bill today.

“The Federals Are Coming!”

Explore the deeper truth behind Paul Revere’s midnight ride and how its spirit of resistance still speaks to America’s modern challenges.

The Precious Metals Week in Review – April 25th, 2025

Gold surged past $3,500 per ounce amid dollar weakness and market volatility, with central banks and investors seeking safety in precious metals. As equities waver and inflation looms, gold continues to outperform, reinforcing its role as the ultimate hedge in uncertain times.

These Amps Go Up to Eleven

Much like Nigel Tufnel in This Is Spinal Tap, investors often cling to appealing illusions—right up until the crash. Here’s how to avoid it.

The Precious Metals Week in Review – April 18th, 2025

In a week of economic chaos, gold proved its resilience—shattering records and reaffirming its status as the ultimate safe haven. With inflation risks, volatile tech stocks, and global uncertainty mounting, precious metals are once again in the spotlight. Is this the beginning of a new golden era?