While the US and Europe have seen many riot situations and we can therefore study how they play out, a series of self-perpetuating riots has not taken place before.

It’s Not “If,” It’s “When”

What once hung over the heads of rulers now threatens entire populations. From debt to war to lost freedoms, the modern Sword of Damocles spares no one. This article challenges blind optimism and urges awareness and action in the face of global decline.

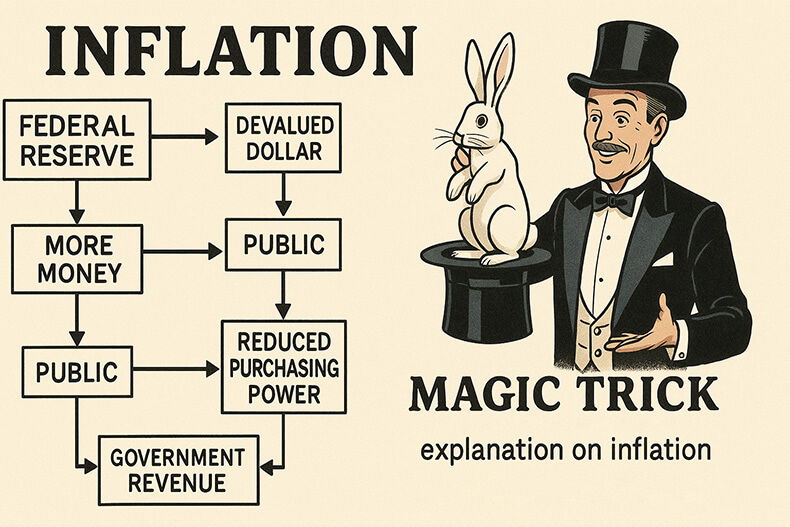

The Magic Trick

Explore how inflation, orchestrated by the Federal Reserve, acts as a hidden tax. This powerful illustration exposes the illusion behind the dollar’s decline.

The Endlessness of a Temporary Tax

Politicians love tax reform—until it’s time to actually lower taxes. This deep dive into the “temporary” telephone tax reveals how reforms are often just reshuffles. Learn how a war from 1898 still affects your phone bill today.

“The Federals Are Coming!”

Explore the deeper truth behind Paul Revere’s midnight ride and how its spirit of resistance still speaks to America’s modern challenges.

These Amps Go Up to Eleven

Much like Nigel Tufnel in This Is Spinal Tap, investors often cling to appealing illusions—right up until the crash. Here’s how to avoid it.

The Right to Bear Arms

The right to bear arms wasn’t rooted in hunting or home defense, but in resistance to tyranny. The Gunpowder Incident of 1775, centered at the Magazine in Williamsburg, inspired the Second Amendment and played a direct role in America’s fight for liberty.

The First Libertarian

Long before Western thinkers like Mises or Hayek, Lao-tzu envisioned a society where freedom thrived and government interference was minimal. Discover how this ancient sage’s insights laid the foundation for libertarian thought centuries ahead of his time.

Who’s Got the Gold?

The end of the gold standard in 1971 set the stage for global currency manipulation. Will gold reclaim its place in the financial world?

The Quest for Alice’s Rabbit Hole

Many individuals exploring internationalisation often face internal resistance, driven by fear and cautious hesitation. While fear serves as an instinctive safeguard, it can also impede beneficial changes. Internationalisation, though daunting, presents significant opportunities when approached with thorough research and prudent judgment. By identifying promising jurisdictions and planting flags in multiple countries, individuals can diversify their assets and escape deteriorating conditions in their home nations. It’s a strategic move for those seeking long-term prosperity and security in a shifting global landscape.