Physical precious metals have a long and storied history as a hedge against inflation, times of geopolitical uncertainty, and times of economic uncertainty.

The Need For Information Filtration

Today, though, we are bombarded with information. The internet certainly has been an incredible boon, as it serves as book, periodical and mail service, all in one, and has the advantage of being immediate.

The Precious Metals Week in Review – February 4th, 2022

1. Market volatility remained elevated this week as better-than-expected employment data triggered fears that the Federal Reserve may become more aggressive in its attempts to battle inflation. 2. For the week ending January 29, the seasonally adjusted number of Americans filing initial claims for unemployment decreased by 23,000 from the previous week’s revised level to…

The Precious Metals Week in Review – January 28th, 2022

Precious metals have a long history as a hedge against inflation and times of uncertainty.

The Precious Metals Week in Review – January 21st, 2022

Inflation, geopolitical uncertainty, and economic uncertainty have frequently driven prices for precious metals higher in the past.

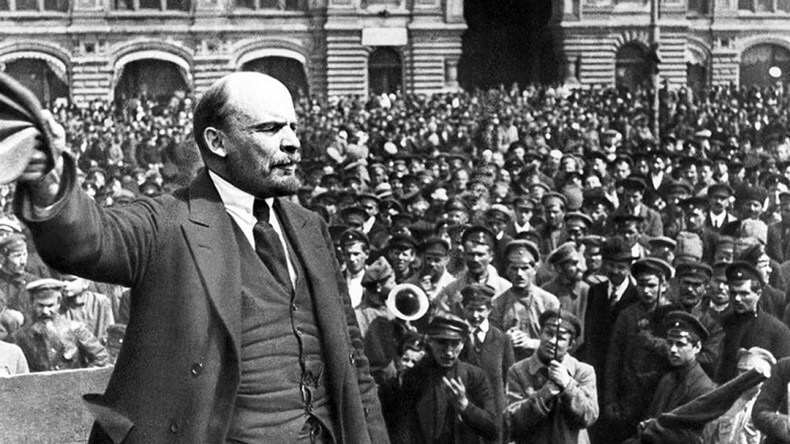

Rulers Seek to Rule

Rulers seek to rule. Ruling is not a side-issue; it is not a bi-product. It is their very purpose. It is the reason why they ran for elected office.

Gold in 2021: Persistent Inflation and a Fed Pivot Provide Hints About 2022

The circumstance of stubborn inflation, elevated political conflicts, and overpriced stock and real estate markets creates an ideal scenario for gold.

The Precious Metals Week in Review – January 14th, 2022

In the current economic and geopolitical environment, savvy investors have continued efforts to ensure that their investment portfolios are sufficiently diversified against the effects of inflation, economic uncertainty, and geopolitical tensions.

The Precious Metals Week in Review – January 7th, 2022

Many investors have included physical precious metals as part of their diversification plans, given their long history as a hedge against both inflation and times of economic turmoil.

Six Impossible Things Before Breakfast

Those who will be the most likely to do well will be those who choose to recognise that, as America declines, there are some countries that are on the upswing.